Table of Contents

- UK Consumer Sentiment Continues Recovery

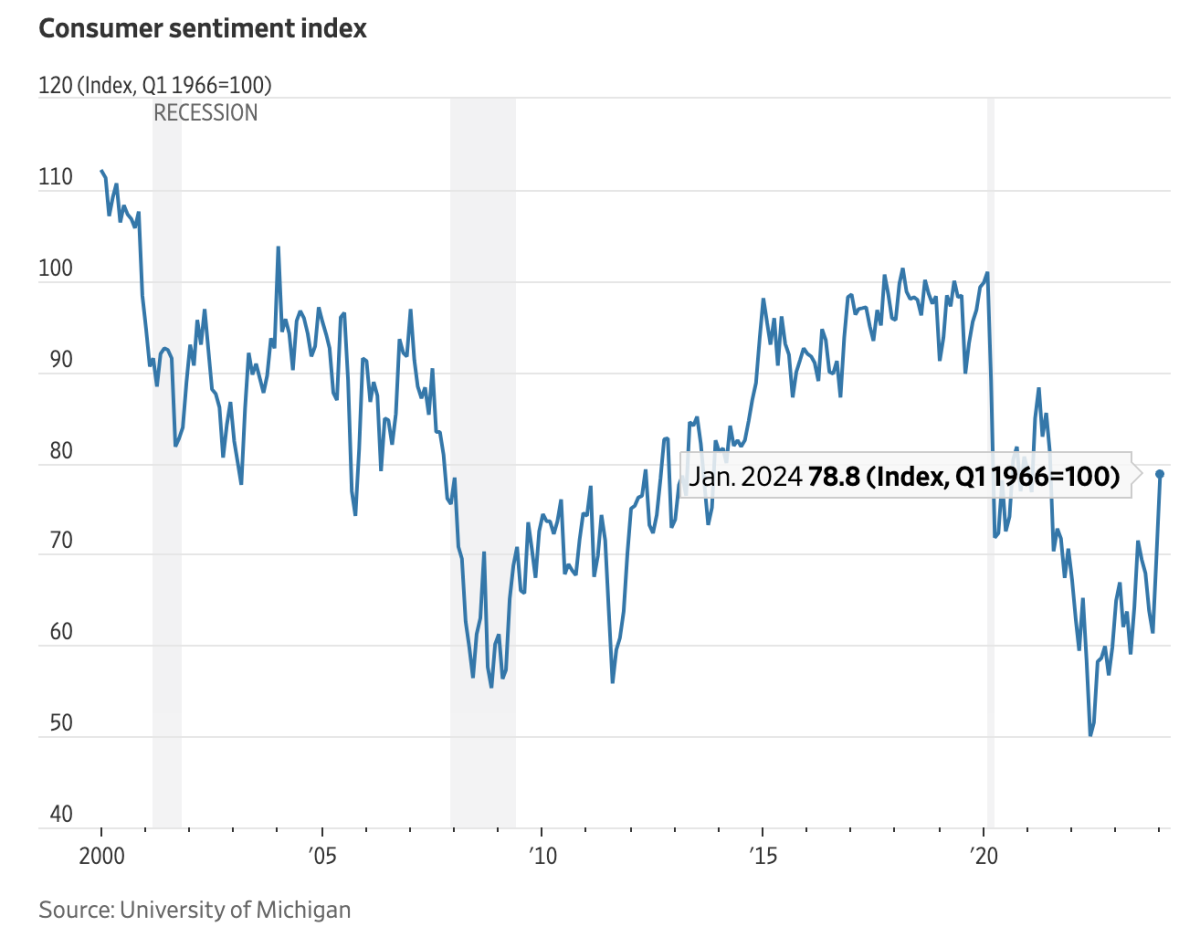

- U.S. Consumer Sentiment Jumps In January, Near-Term Inflation ...

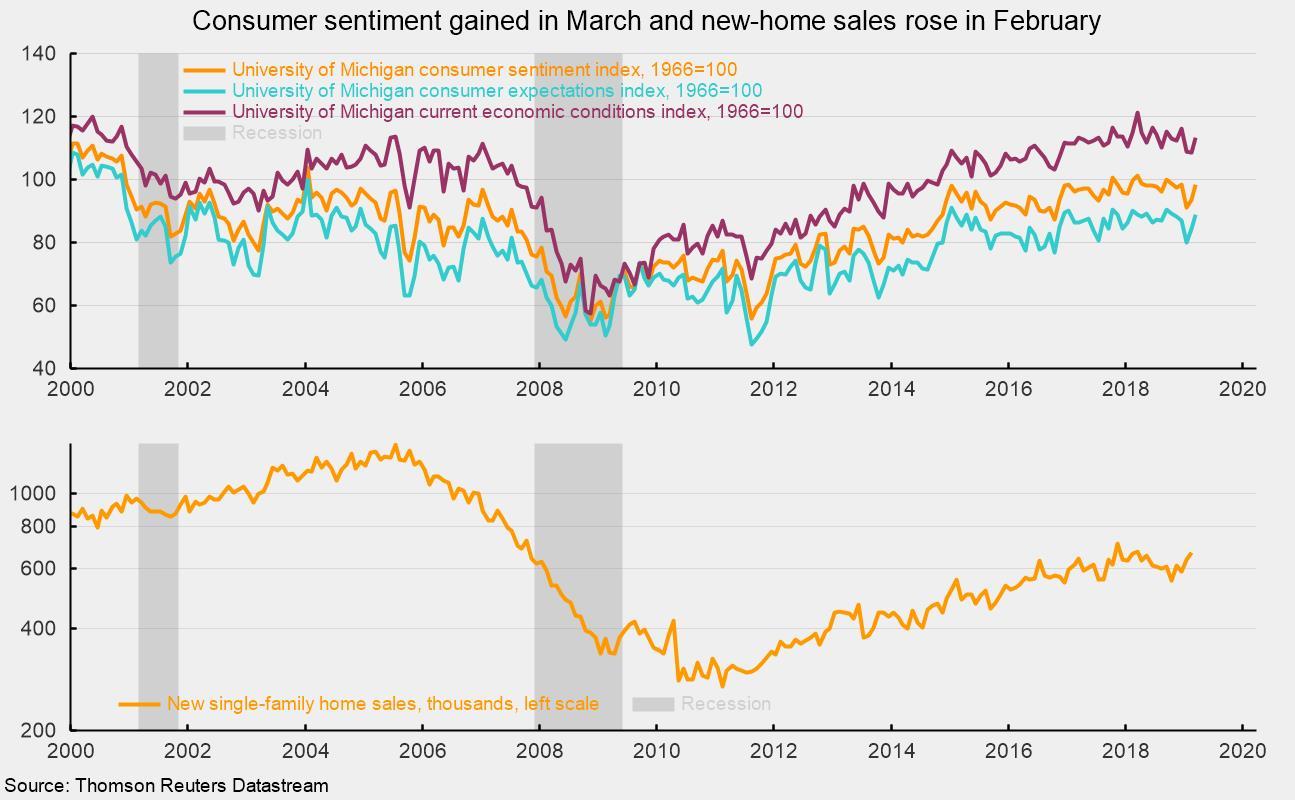

- Consumer Sentiment And New Home Sales Post Gains | Seeking Alpha

- The Ultimate Guide to Analyzing Consumer Sentiment

- Consumer Sentiment Skyrockets As Americans Feel The Strong Economy ...

- U.S. Consumer Sentiment Unexpectedly Drops To Eight-Month Low In July ...

- Michigan Consumer Sentiment Misses Analyst Estimates

- Customer Sentiment Analysis: What Is It and How To Collect Data for It

- Why Consumer Sentiment Fell To A Seven-Month Low - UnemploymentData.com

- Michigan Consumer Sentiment: July Final Slightly Worse Than Expected ...

Inflation Fears on the Rise

Key Factors Contributing to Inflation

- Supply Chain Disruptions: Ongoing supply chain issues, exacerbated by the pandemic, have led to shortages and price hikes for essential goods.

- Rising Energy Costs: Increased energy prices are having a knock-on effect on the cost of production, transportation, and ultimately, consumer prices.

- Monetary Policy: The expansionary monetary policies implemented during the pandemic have led to an increase in money supply, contributing to inflationary pressures.

Impact on Consumer Behavior

- Reduced Spending: Consumers are cutting back on non-essential expenses, opting for savings and debt repayment instead.

- Shift to Value-Based Purchasing: Households are becoming more price-conscious, seeking value for money and opting for cheaper alternatives.

- Increased Price Sensitivity: Consumers are becoming more sensitive to price changes, with even small increases leading to a decline in demand.

- Monetary Policy Adjustments: Central banks can adjust interest rates to curb inflationary pressures.

- Fiscal Policy Interventions: Governments can implement policies to support low-income households and promote economic growth.

- Supply Chain Diversification: Businesses can diversify their supply chains to reduce reliance on single sources and mitigate the impact of disruptions.